Learn How to Navigate Charitable Contribution Regulations

Donations of personal property to qualified organizations are deductible only if they follow certain guidelines.The items must be assessed at their fair market value, a term specifically defined by the IRS. Appraisals by qualified appraisers are required if the claimed donation deduction is more than $5,000. If the items are used clothing or household items and have a claimed value of over $500, and are in poor condition, an appraisal is required as well.

The appraisal can’t be done prior to 60 days of the gift, although it can be done after. The appraisal must follow the IRS regulations and include specific information, such as a proper description, an evaluation of the condition, the method of valuation, and the basis for the valuation, such as comparable sales transactions.

Appraisers must meet both educational and experiential requirements and regularly prepare appraisals.They must demonstrate verifiable experience in valuing this specific type of property and must declare so in the report. The individual must not be “excluded” or prohibited from practicing before the IRS.

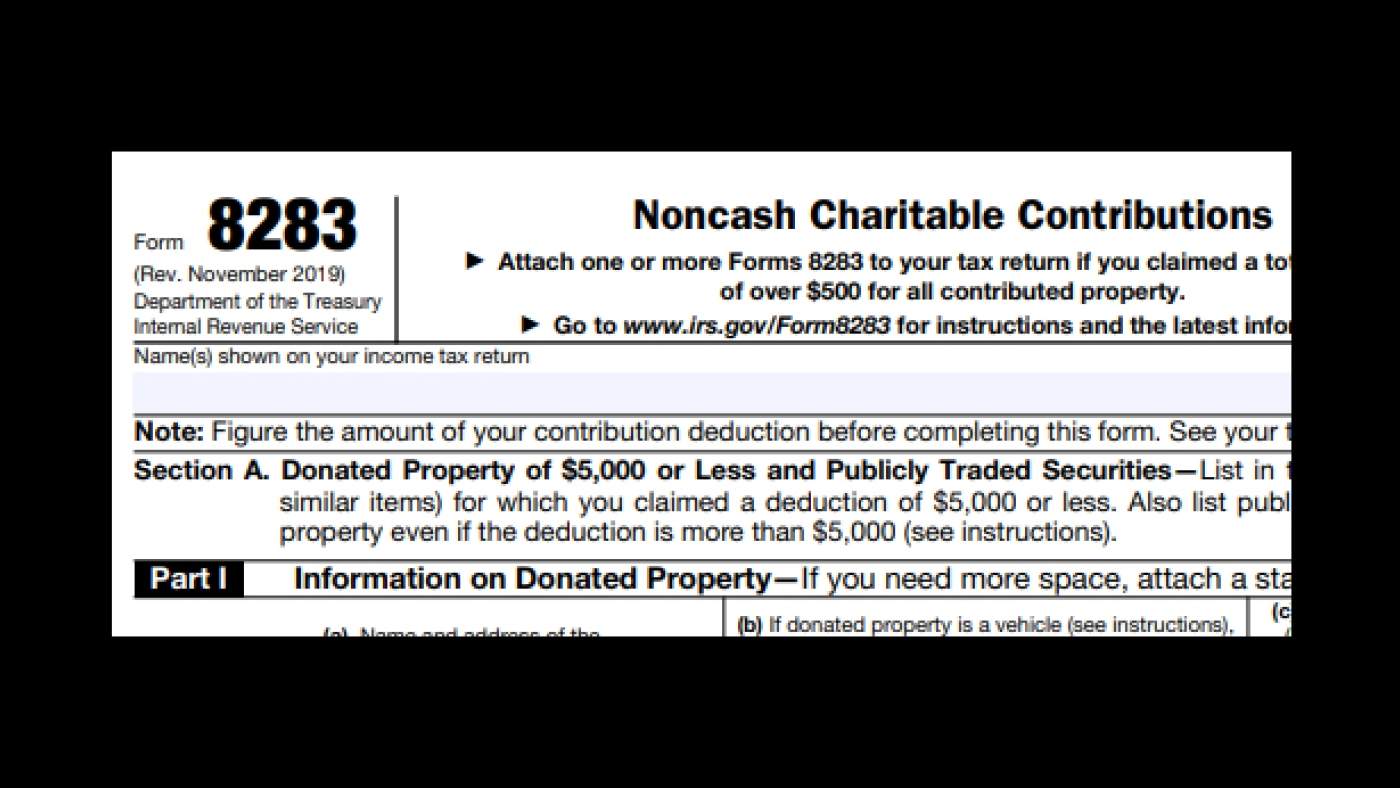

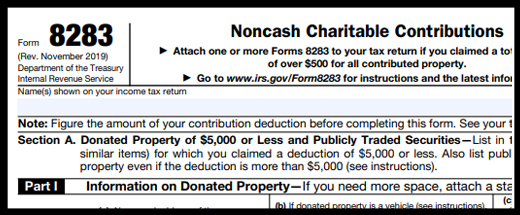

The appraiser must complete the 8283 form, which is then filled out by the owner and the charity. If the appraised value is over $20,000, a copy of the appraisal must be included with the tax return. A taxpayer may request a Statement of Value on artwork over $50,000, prior to the filing for pre-approval, but the application must include a copy of the appraisal, the signed 8283, and a fee of $2,500.